"Overnight Flows"; ReSale TALES; 10s TO 1.52 (Cornerstone MACRO via twtr); The Weekly Fix

First, an hourly visual of FV showing how very close we got TO an important level (119-29 - a level which exposes short-base vulnerability) and where we are this morning, ahead of ReSale TALES (as of 703a):

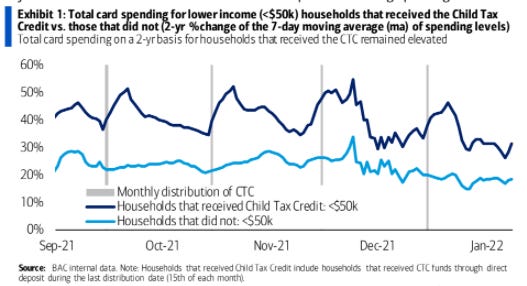

I’ve noted momentum — overSOLD — but am not normally a fan of looking at momo on this hourly format. Then again, for the degenerate bond market gamblers here among us, perhaps it means a ‘hold’ of sorts and potential retest of 119-29 **IF** ReSale Tales is disappointing enough? BofA on USA - Child Tax Credit Expiration not yet a drag on spending,

ReSale Tales (or earnings — which ever sells THE narrative better), aside, here’s a recap of what happened, as per THE best in the (strategy) biz,

Treasuries sold off overnight, with 7s as the underperformer. Overnight volumes were above the norm with cash trading at 112% of the 10-day moving-average. 5s were the most active issue, taking a 36% marketshare while 10s a distant second at 29%. 2s and 3s combined to take 21% at 11% and 10%, respectively. 7s managed 8%, 20s 1%, and 30s 5%. We’ve seen two-way flows in 10s, as well as buying in 20s and 30s.

735a: Check back later on for MORE color — inserted here — in as far as what ELSE happened overnight.

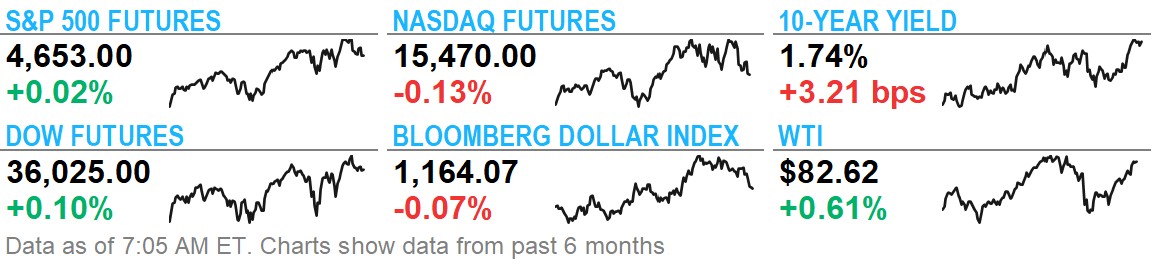

Treasuries are lower and the curve a hair steeper this morning despite lower global stocks and more sabre-rattling in/over Ukraine (see above). DXY is little changed while front WTI futures are modestly higher (+0.6%). Asian stocks were lower (NKY -1.3%, SHCOMP -1%), EU and UK share markets are all in the red too while ES futures are showing -0.1% here at 7:15am. Our overnight US rates flows saw USTs caught in the crossfire during Tokyo hours as JGB's got hit hard after Reuters reported (see link above) that BOJ officials may start to telegraph eventual rate hikes. Once things settled a bit, real$ names emerged as buyers- first in 5's and later in 10's during their afternoon. Our London desk saw elevated activity this morning, largely in the long-end via HF's and foreign real$ names. The desk did also note profit-taking in ASW space from holders of off-the-run paper ahead of potential QT. Overnight Treasury volume was ~95% of average overall with 5's, 20's and 30's seeing the highest relative activity at ~115% of averages.

…Our last attachment this morning is a fresh updated from the MOF of Japan's net foreign bond activity. As you can see, Japan has recently returned as a net buyer of foreign bonds at these higher yields after shedding foreign bonds into the end of the year.

Changing lanes for now, thinking FED (and how many, not IF or what breaks) HIKES, of note (via RTRS)

A historically DIVERSE board doesn’t necessarily make it great. Just diverse. Think about it…read up and learn about the picks and their views, process, and predispositions (ie RASKIN and her husband and his political views — guilt by association, then) BEFORE jumping to (and pricing) in any conclusions and narratives…ZH HERE for some of the snark missing

And as far as some economic data overnight,

Nikkei China trade surplus at record as exports rise 20.9% and imports up 19.5%.

But **IF** you look just beneath the headline, which NWM has, you’ll note,

However, in volume terms, both exports and imports growth slowed, suggesting that domestic and external demand may have continued to moderate in December.=

What’s all this add up to? HIGHER RATES of course. Unless, you believe things you see on twitter,

And finally, a weekly newsletter from Bloomberg, dedicated TO the FI markets,

The Weekly Fix: Rate-Hike Frenzy, Bonds Scent Inflation Peak

…March pricing at a 90% chance for a hike is now looking conservative given the wave of Fed hawks. And the curve can steepen further seeing it is now based on 3.5 hikes by year-end, while Fed officials sounded like auction participants, opening with three hikes, raising that to four and then even compassing the potential for five.

All that proved very tough medicine for technology stocks to swallow, as investors judge the sector benefits more than most from low yields and so now will suffer from the coming regime change. A key part of the dynamics for bonds and stocks are the strong signs that central banks are willing to look past the omicron-fueled surge in the pandemic and stay the tightening course. The Bank of Korea underlined that dynamic in delivering a rate increase on Friday. Traders Down Under are also certain the Reserve Bank of Australia will be forced to raise rates way ahead of Governor Philip Lowe’s guidance, despite economists slashing first-quarter GDP forecasts as omicron disrupts consumer spending ...

… Returning as promised to bonds themselves, they were traveling fairly well for much of this week. Breakevens dropped on the day of the CPI report -- the biggest such decline in a decade -- and then extended the move the following day when a report showed producer prices decelerated. That shows that investors may be deciding that the recent runup in yields has gone far enough to make bonds worth buying and holding, especially if the Fed aggression mentioned above reins in inflation sooner rather than later.

There still look to be more reasons for bearishness than bullishness, as underscored by plenty of interest among options traders in buying protection against a 1.95% 10-year U.S. yield. One key concern is also the potential that the laws of supply and demand will return to global bond markets this year. Central banks are cutting back their bond purchases faster than governments are winding back spending, so the amount of sovereign bonds hitting the private sector is set to swell in 2022, adding pressure on yields to rise further.

That’s also causing higher volatility and some strong shifts in the way investors are deploying their money. Municipal bond investors just pulled money from high-yield mutual funds, possibly calling time on unprecedented inflows muni funds enjoyed for much of the last year.

And that is all (for now), folks … Sellside observations and weekly economic indicators Sunday evening (even though ca$h bond markets will be closed due to holidays …